Surat, November 2025:

A disturbing incident involving continuous harassment by automated calls has raised serious concerns over the functioning and verification practices of CreditQ, a business reporting and debt data platform. Manish Jain, a Surat resident and active member of the National Crime Investigation Bureau (NGO), reportedly received 30 to 40 robocalls daily for five consecutive days, despite having no connection to the company’s listed defaulter. The issue arose after CreditQ mistakenly linked Jain to a Muskan Trading Company based in Ulhasnagar, Maharashtra. Jain, however, runs Muskan Trading Co. in Surat, a completely unrelated brokerage firm with a different GST number, business type, and location.

Wrong Identity, Yet Repeated Harassment

According to Jain, the company did not attempt to verify its data before repeatedly contacting him. Instead, CreditQ allegedly asked him to submit firm documents and provide a letter on his company letterhead confirming that he was a “different person.”

“Why should I share my firm documents with an unknown, unauthorised platform, especially when the mistake is entirely theirs?” Jain asked, pointing out that he had never shared his number with any such Maharashtra-based entity.

Victim Solved the Case Himself

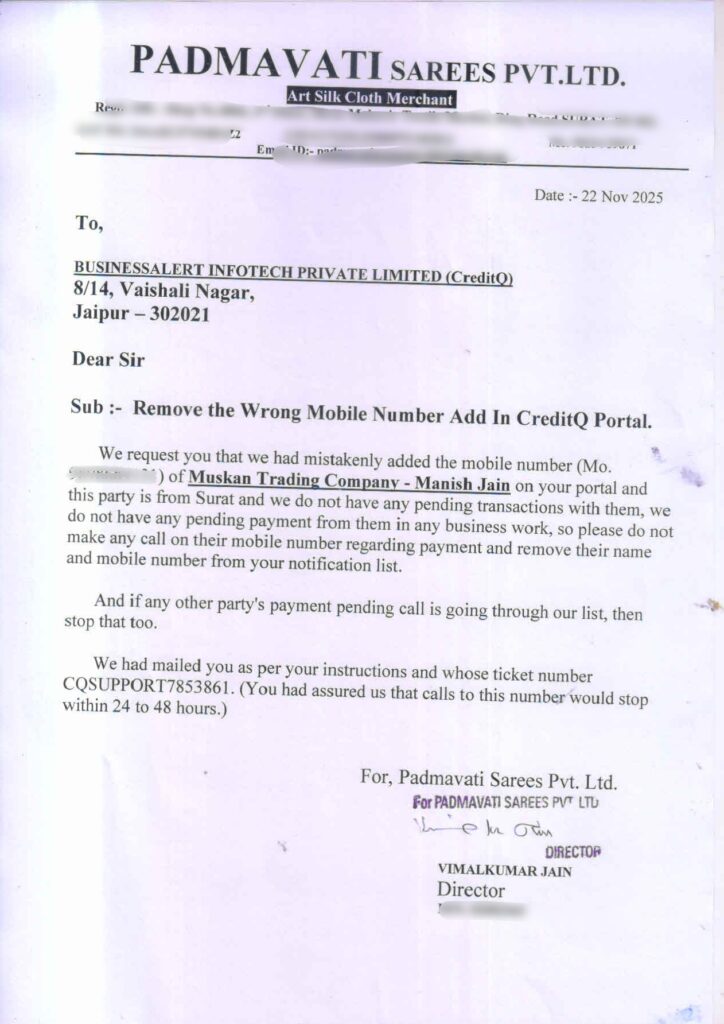

CreditQ did not guide Jain in identifying the issue.Taking the matter into his own hands, Jain contacted Padmavati Sarees Pvt. Ltd., one of the firms involved in the dispute. Padmavati confirmed that their outstanding matter was with a different Muskan Trading Company in Ulhasnagar. They immediately corrected their records.However, CreditQ’s robocalls continued even after the correction, raising concerns about delays or failures in its internal update and verification processes.

NCIB Provided Support and Intervention

As a member of the National Crime Investigation Bureau (NGO), Jain approached his organisation for support. The Director General of NCIB, Shri Suresh Sukhla, offered guidance and indicated readiness to escalate the matter through official channels.With NCIB’s assistance, Jain eventually succeeded in having his number removed from CreditQ’s system without sharing any firm documents, highlighting that the platform’s earlier demands were unnecessary and improper.

Transparency Concerns Over CreditQ Website

Jain also noted that the CreditQ website lacks a physical office address and grievance contact details, raising further questions about transparency, accountability, and compliance with standard business norms.

Cyber Complaint Redirected

Although Jain filed a cyber complaint, Gujarat Police directed him to submit details on Sanchar Saathi, the central telecom abuse portal. Jain highlighted the impracticality of manually uploading 40 different call numbers daily, calling it unreasonable for any victim of such harassment.

Call for RBI and TRAI Intervention

The case raises serious regulatory concerns:

Should platforms be allowed to make robocalls to DND-registered numbers without verification?Why did CreditQ ask the victim for documents instead of reconfirming details with their paying client?Why did calls continue even after the client corrected the data?Why does the company’s website lack mandatory contact information?What verification protocols exist before uploading personal data to such platforms?

A Need for Stronger Oversight

Consumer safety experts believe that the incident underscores the need for stronger oversight from RBI and TRAI, as unchecked automated calling systems and inadequate verification processes pose a risk to citizens.“If authorities do not intervene, more individuals may face similar harassment due to data errors and automated call platforms operating without proper safeguards,” Jain said.